how to calculate 13th month pay philippines|Calculating 13th Month Pay in the Philippines : Clark 1. Employees. 2. Employers. How Is the 13th-Month Pay Computed? A More Detailed Discussion. 1. How To Compute 13th-Month Pay if You Have Absences Without Pay/Maternity Leave/Unpaid Leaves/Paid Leaves/Late Record. 2. How To Compute . Kantotin.com delivers pinay sex scandals and pinay sex videos everyday. You can also watch amateur and premium porn videos here.

PH0 · Step

PH1 · It’s Easy To Calculate Your 13th Month Pay!

PH2 · How to Compute Your 13th Month Pay (With Free Calculator)

PH3 · How to Compute Your 13th Month Pay

PH4 · How to Compute 13th Month Pay: A Complete Guide

PH5 · How to Compute 13th Month Pay in the Philippines

PH6 · How To Compute 13th Month Pay (With Free Calculators)

PH7 · Here’s how to compute your 13th month pay

PH8 · Guide to 13th

PH9 · Calculating 13th Month Pay in the Philippines

PH10 · A Quick and Easy Guide To Computing Your 13th Month Pay

PH11 · 13th

PH12 · 13 Month Pay Computation in the Philippines [Complete Guide]

In line with the UK legal gambling age limit, you must be at least 18 years old to create an account or enjoy the Bet365 2 goals ahead promo. Is there a limit to the number of times the 2 Goals Ahead promotion can be used? No, there's no limit to the number of times the promo can be used. However, the promo will end on the 31st of December, 2024.

how to calculate 13th month pay philippines*******1. Employees. 2. Employers. How Is the 13th-Month Pay Computed? A More Detailed Discussion. 1. How To Compute 13th-Month Pay if You Have Absences Without Pay/Maternity Leave/Unpaid Leaves/Paid Leaves/Late Record. 2. How To Compute . Learn how to compute your 13th-month pay based on your total basic salary earned during the year and the DOLE guidelines. .

For the formula, all you need is the basic salary, and then simply divide it by 12. Total basic salary per year / 12 = 13th month pay. For example, if an employee .how to calculate 13th month pay philippines Learn how to compute your 13th month pay based on your basic salary and length of service for the year. Find out what is .

how to calculate 13th month pay philippines Calculating 13th Month Pay in the Philippines Learn how to compute your 13th month pay based on your basic salary and length of service for the year. Find out what is .

Learn how to calculate your 13th-month pay based on your basic salary and the legal requirements. Find out who is eligible, when to receive it, and what to include or exclude from the computation. Learn the formula and the tax implications of this mandatory benefit for employed workers in the Philippines. Find out who are entitled and who are not to .

To calculate your 13th-month pay, simply multiply your basic monthly wage by the number of months you worked for the full year, then divide the result by 12 months. .Learn the eligibility criteria, tax exemption limit, and exclusions for this law-mandated benefit. Find out how to calculate 13th Month Pay manually or use MPM Payroll software for a no-fuss preparation.

To compute for the annual 13th-month pay entitlement using this formula: 1) Add up all the basic salaries received within a year. 2) Divide by 12 months. 3) Multiply by one month’s basic salary. 4) The . Step 2: Since Sarah has no deductions, the total salary will still be ₱245,000: Prorated 13th Month pay = ₱245,000 – 0= ₱245,000. Step 3: Divide the result by 12 (total months in a year) to determine the prorated 13th-month pay: Prorated 13th Month pay = ₱245,000 / 12 = ₱20,416.67.

Under the law, the 13th-month pay shall not be less than one-twelfth (1/12) of the total basic salary earned by an employee within a calendar year. “Total basic salary earned during the year (12 months) = proportionate 13th-month pay,” it said. Using the basic wage in the National Capital Region at PHP537 per day and a six-day workweek .

Suppose an employee, has a total basic salary of PHP 20,000 per month. To calculate John’s 13th-month pay for a year, follow these steps: Determine Total Basic Salary Earned: Total Basic Salary Earned = P20,000/month × 12 months = P240,000. Apply the Formula: 13th month pay = Total Basic Salary Earned / 12. 13th month pay .

Guidelines on the Payment of Thirteenth Month Pay

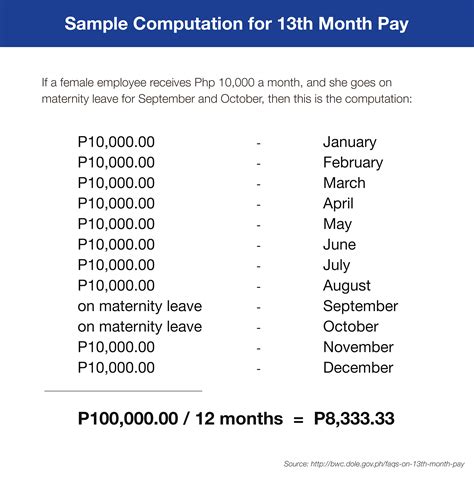

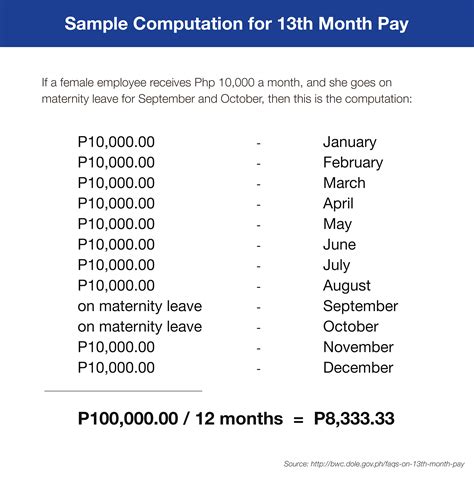

P180,000 / 12= P15,000. In this case, the 13th month pay will be P15,000. If an employee worked for 10 months of the year, and had 2 months unpaid leave, and the basic monthly pay is P15,000, then the 13 th month pay will be: P15,000 x 10=P150,000. P150,000 / 12= P12,500. The employee will get P12,500 as the 13th month pay.

Department of Labor and Employment To calculate your 13th-month pay, you can follow this formula: (Total Basic Salary Earned for the Year) / 12. In your case, you started working on October 2nd, so you would calculate your basic salary for that period. Assuming you earn 650 pesos for 5 days a week, you can multiply this by the number of weeks you worked in October and then .

To compute the 13th-month pay, calculate the total basic salary you have earned during the year, then divide it by 12 months. For example, for an employee earning P14,000 per month who has perfect attendance, worked for 12 months, and never took a day off, the computation would be as follows: P14,000 * 12 months = P168,000. .

To compute your 13th month pay, multiply your basic salary by the number of months you have worked for the year to get your total basic salary. For this example, P30,000 multiplied by 9.5 months . To compute their 13th month pay: ₱20,000 × 6 months = ₱120,000. ₱120,000 ÷ 12 = ₱12,000. Thus, Employee B's 13th month pay would be ₱12,000. For an automated calculation, you can also use a 13th month pay calculator. This calculator also shows the taxable portion of the 13th month pay.So, here's the step by step guide on how to use the 13th Month Pay Calculator. Step 1. There are twelve (12) input fields on the calculator labeled by its corresponding month. It is a complete set of months of the entire year from January up to December. Enter the Salary each month. For example: January 10,000, February 20,000 and so on. Step 2. How to Compute for your 13th Month Pay. The formula used for your well-anticipated pay is ‘basic pay multiplied by the length of employment in months divided by twelve’. It can be illustrated in . The following are the conditions to be entitled to 13 th month pay: 1) That the employer is not excluded from the coverage of P.D. 851 or the 13 th Month Pay Law; 2) That the employees are rank-and-file employees; and. 3) That the said employees should have at rendered least thirty (30) calendar days of service. 13monthpay = total basic salary within the calendar year / 12. Employees who are entitled to 13th Month Pay. According to the Memorandum Order No. 28 issued by former President Corazon C. Aquino on August 13, 1986, which has modified Section 1 .The 13th month pay shall be in the amount not less than 1/12 of the total basic salary earned by the employee within the Calendar day. Example: Let say an employee basic salary is Php15,000 per month and had worked for 10 months, the 13th month computation is: (Php15,000 X 10 months) / 12= Php12,500.00.

Computing your 13 th month pay. The 13 th Month Pay is computed based on 1/12 of the total basic salary of an employee within a calendar year, or basic monthly salary for the whole year divided by 12 months. By law, an employee’s 13 th -month pay cannot be less than 1/12th of their overall basic salary within a 12-month calendar year. Here's the computation from a Senate briefier on taxes. Your 13th month pay is taxable up to P90,000. Anything in excess will be subject to income tax. Say, your 13th month pay is P120,000, the P90,000 is tax-free while the excess P30,000 is taxable. If you are in the 20% income tax bracket, that's less P6,000 from the P30,000 excess.

Let's explore how to calculate the 13th-month pay under these circumstances. Legal Overview: In the Philippines, the 13th-month pay is a mandatory benefit provided to employees, typically equivalent to 1/12th of their total basic salary earned within a calendar year. However, when employees have been absent during the .

Mozzart Daily Jackpot Predictions. Mozzart Daily jackpot tips are provided to all our subscribers in a bid to win Ksh20 million which is paid to those getting 16/16 games correct.To get the best tips for this jackpot, subscribe by paying Ksh 500 for one month or Ksh 200 for one week.

how to calculate 13th month pay philippines|Calculating 13th Month Pay in the Philippines